Should you get financing, you pay it right back contained in this some time. Because you might know, the principal amount therefore the desire is actually repaid more specific monthly installments. Here, wouldn’t it be much better for people to take some sort of chart that explains brand new fees plan clearly?

However. That is where the financing repayment plan will come in. In other words, the brand new fees schedule is actually a chart or a graph one facts how you will repay a home loan as a result of some normal installment payments. These types of installment payments are generally referred to as EMIs, comprising the primary balance plus the notice role.

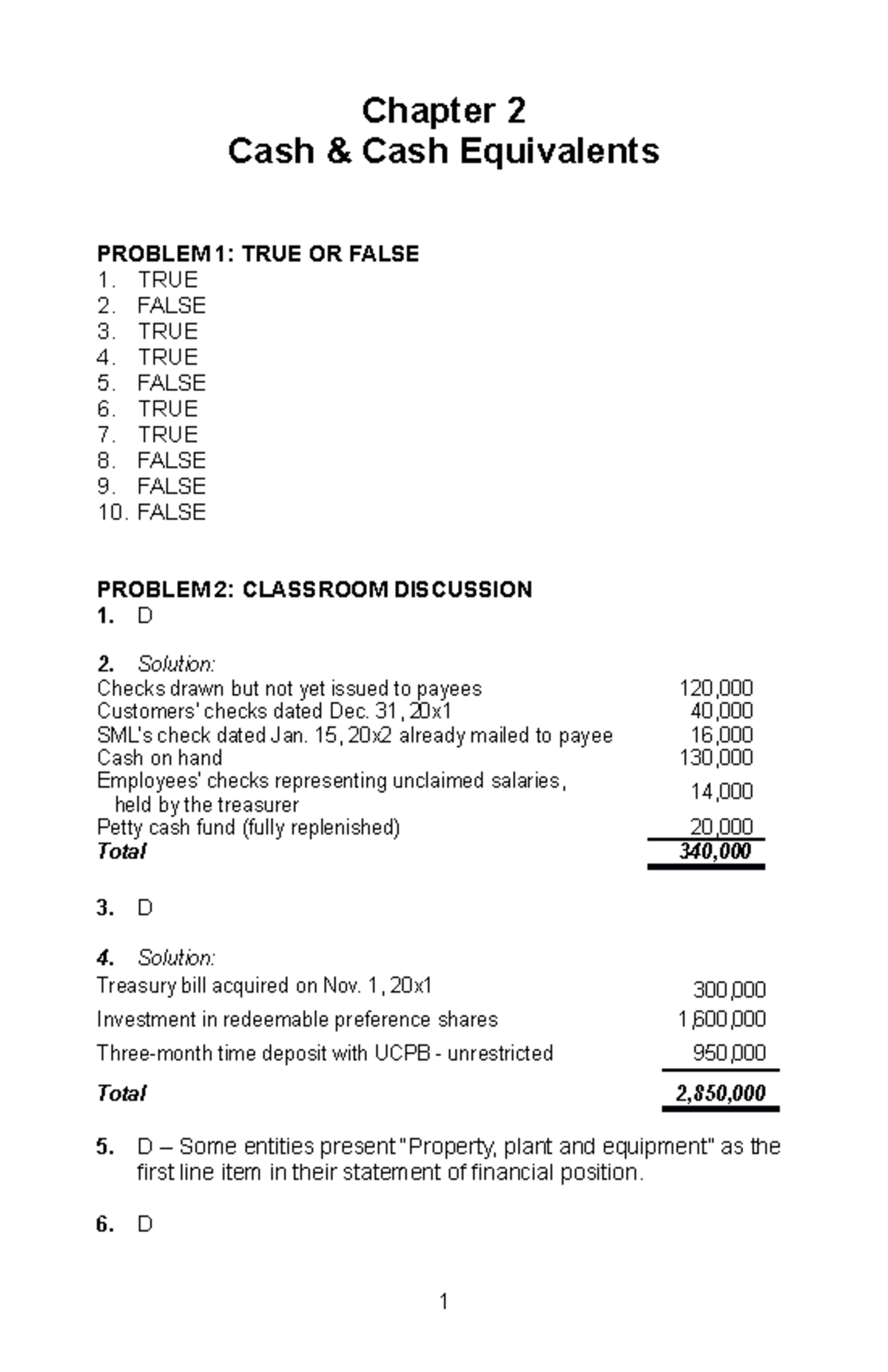

What’s an Amortization Table?

The home loan pay schedule try explained on amortization desk or perhaps the amortization schedule, which the bank shares into debtor. Amortization ‘s the month-to-month breakup of one’s dominating and loan attract inside financing tenure. A loan amortization calculator might be accustomed create it table. With regards to the loan term and you will rate of interest, the new debtor could see the way the month-to-month EMI is certian into the dominant payment and focus money.

- Cost serial number

- The fresh new deadline for each and every EMI fee and that constitutes the brand new installment schedule

- First information on the house mortgage

- The hole principal matter and therefore implies the attention chargeable matter during the the start of every month

- Brand new closure dominating count and therefore means the remaining prominent amount after an EMI was paid off

- Interest part

What makes the house Mortgage Payment Agenda Important?

Really, which have a mortgage cost schedule handy lets both the lender additionally the borrower keep track of the prior and you may up coming payments. At exactly the same time, in addition provides a definite picture of the brand new a fantastic equilibrium otherwise desire any kind of time point in brand new period.

Surprisingly, you don’t have to rating a mortgage to know its amortization schedule. Certain lenders eg PNB Houses enables you to look at the agenda whenever you are merely calculating the home financing EMI regarding the first level of getting home financing. So it raises an appealing matter: just how ‘s the home loan repayment agenda determined? Why don’t we see.

Ideas on how to Calculate Mortgage Cost Schedule Having Home loan EMI Calculator

The home financing EMI calculator regarding lenders such PNB Homes simplifies EMI calculations whilst enabling people understand you can easily mortgage cost schedule. We could point out that the newest installment schedule is determined making use of the EMI calculator device. At all, figuring the new you can EMI to own a specific loan amount, loan tenor, and you can interest rate contains the solution to methods to pay it well inside an intermittent style.

For this reason, a mortgage EMI calculator is an effectual and simple on the internet device one estimates their EMIs, total house mortgage fee, and you may interest percentage agenda at once.

Do you want to understand how a keen EMI calculator having a great family mortgage really works? They uses an algorithm to determine the newest EMI and its own installment plan basis the primary matter, period, and you may rate of interest entered:

Although calculations usually do not avoid right here. This formula only provides the new month-to-month EMI. However, a loan amortization agenda details exactly what element of new EMI happens for the dominating percentage and you may exactly what happens towards the attract. In order to compute this, one can possibly utilize the pursuing the formula:

For instance, consider a loan amount out-of fifty lakh, a 30-season period, a great 6% interest rate, and you will an EMI from 31,978. By using the above formula, we can find out the details of the first EMI fee.

During the an equivalent vein, you could assess the primary commission and you will attention areas of the brand new leftover weeks with the previously mentioned formula. Because you will look for, this will make you a table out of sorts in which the principal element of their EMI will stay broadening as the appeal parts helps to keep declining.

Conclusion

Now you know everything about the house mortgage fees plan, you’re wondering which one provides you with a better amortization a smaller tenure or a lengthier tenure?

Really, definitely, new smaller the fresh period, the loans in Forestdale newest smaller will be your amortization plan. This way, it is possible to keep up on the eye part of the home loan. Yet not, your EMI outlay could be highest. On the other hand, a lengthier amortization agenda means a more impressive attract component.

not, their monthly EMI was more reasonable. It is possible to will prepay your loan during the period. This can slow down the period or their EMIs, while the total price of financing. Therefore, you could grab a trip based upon your financial believe.

To understand more info on the way the financing fees schedule really works otherwise may benefit your, don’t hesitate to get in touch with the customer support team at the PNB Construction!