Yes, you could potentially re-finance ahead of offering your property, particularly when latest interest rates was less than when you first ordered your home. Whether you ought to or perhaps not depends on your situation. It would be a good idea when you can lower your interest rate a great deal, if you would like stay static in your home more than planned, or if you have to do some renovations to increase your own residence’s really worth ahead of attempting to sell. However it is not at all times the first choice, especially if you want to sell very soon.

What’s Refinancing?

Just before i diving in, why don’t we explore what refinancing form. Refinancing is when you have made an alternate home loan to replace their dated you to. It’s for example change in your dated car finance having a unique one, even though you still have a similar automobile!

Refinancing Options

Refinancing their financial would be a terrific way to spend less, reduce your monthly obligations, otherwise tap into your house’s security. There are several refinancing solutions, per along with its individual gurus and you may considerations.

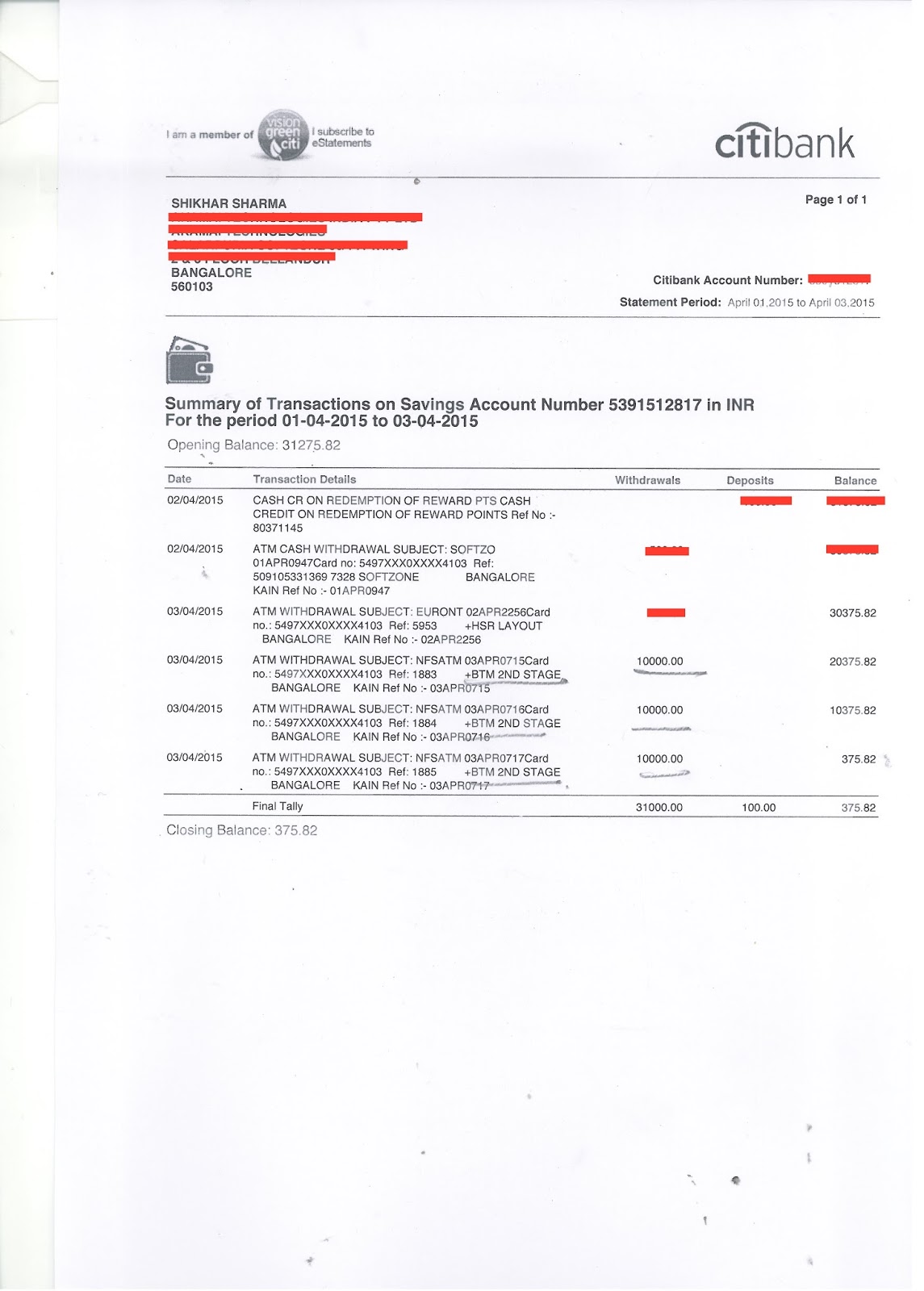

Cash-Out Refinance

A finances-aside refinance enables you to use over you borrowed towards your mortgage, using the change to pay for costs eg house repairs, debt consolidation, otherwise major orders. Such re-finance are of use if you would like availability in order to cash, but it’s required to think about the perils, such as for instance boosting your obligations and you will monthly installments. payday loan online Beaverton AL From the opting for a profit-aside re-finance, you can influence their house’s guarantee for lots more currency for instant means, however, be mindful of the latest much time-label affect your debts.

Rate-and-Name Refinance

An increase-and-name re-finance relates to substitution your financial with a brand new you to definitely having a separate interest rate, mortgage term, otherwise one another. These re-finance makes it possible to decrease your monthly installments, option from a variable-price to a fixed-price financial, otherwise reduce your loan term to repay their home loan quicker. If you are searching to save money towards the attract or create your monthly premiums a great deal more predictable, a speeds-and-title re-finance could be the right one for you.

Can you Re-finance Before Selling?

Brand new quick answer is yes, you might refinance prior to offering your property. There isn’t any code you to definitely states you cannot re-finance even though you might be probably offer. But if or not you will want to re-finance try a unique matter.

In relation to selling your property shortly after refinancing, look out for prospective restrictions instance holder-occupancy conditions and you may prepayment penalties, and you can see the breakeven point-on refinancing will cost you before generally making a good decision.

Why must People Carry out a cash-out Refinance Ahead of Promoting?

- All the way down Interest rate: When you can rating a lower interest rate, you could potentially spend less even though you offer in the future.

- All the way down Monthly obligations: If you want to stay in your residence more than planned, lower money may help. Simultaneously, contrasting their fresh and you may the newest monthly mortgage payment normally show the fresh new deals hit by way of refinancing.

- Cash-Out for Home improvements: You could use an earnings-out re-finance to pay for improvements that may help your home bring in alot more.

- Switch to a fixed-Rates Financial: If you have a changeable-price financial, using a fixed speed could make your payments way more foreseeable when you are selling.

- Family Equity Mortgage to possess Renovations: Unlike refinancing, you can envision a house equity loan to finance renovations. This enables one to supply your own property’s well worth versus inside your brand-new home loan, taking finance for solutions otherwise updates that’ll increase your residence’s market price.

When You’ll Refinancing In advance of Promoting End up being smart?

- You could potentially lower your interest by the at the very least step one%

- You will want to reduce attempting to sell to have annually or even more

- You should do renovations to increase their house’s worthy of

- Your credit score have improved much since you had their current financial