When you do an earnings-out refinance, you usually are unable to get financing for your worth of your house

Your home is an investment, while the security of your home is a thing you could and you will will be used to achieve your economic specifications. Cash-aside refinances and you will house security money was each other methods for you to rating bucks from your own home to do things such as redesign their household, pay for university fees otherwise consolidate loans.

A house security financing is another mortgage which is separate out-of their financial, plus it allows you to borrow on the latest equity in your domestic

Let’s glance at the i thought about this differences between cash-away refinances and you may family security financing, to select the loan choice that is true for you.

A cash-out refinance is a new first mortgage that enables one to pull out some of the collateral you’ve built in our home because the bucks.

You’re capable of an earnings-out re-finance if you have had your own mortgage loan for a lengthy period one you’ve depending guarantee home. But most people find capable manage a funds-aside refinance when the worth of their residence climbs. If you suspect your house worth have increased as you ordered your residence, you are able to perform a finances-aside re-finance.

If you a money-aside re-finance, you alter your present financial with a new that. The mortgage matter towards the the brand new home loan exceeds the fresh new amount you currently owe. Just after financing fund are disbursed, you wallet the essential difference between your loan amount along with your current real estate loan equilibrium with no guarantee you may be making in your home and you will people closure costs and you will charge.

Just to illustrate: You reside well worth $two hundred,000, and you also owe $100,000 in your financial. To take cash out, you always must exit 20% collateral ($40,000) at your home. If you were to re-finance your house with a new financing quantity of $160,000, you might get to pocket $sixty,000, without settlement costs and you may fees.

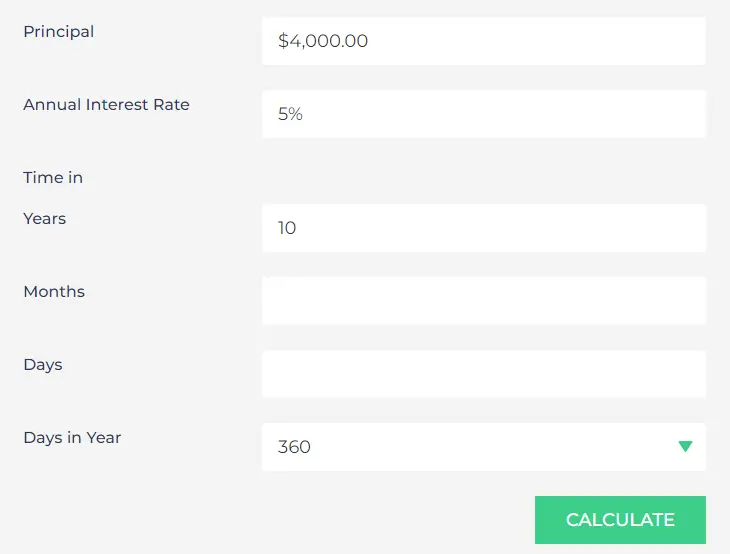

Naturally, your own monthly installments carry out raise so you can account for the latest financing amount. You could guess your brand new monthly obligations with this refi calculator.

To be eligible for a profit-out re-finance, Government Homes Administration (FHA) and you can old-fashioned funds need you to leave 20% equity of your home. Virtual assistant funds is an exclusion, while they provide a funds-out loan for 100% of one’s property value our home.

The money you get off an earnings-out re-finance was income tax-totally free and will be used at all you adore. Really residents who do a cash-out refinance make use of the money to own home improvements, although cash is your own personal to make use of nevertheless find fit.

As opposed to a profit-aside re-finance, a house collateral mortgage cannot change the financial you already have. Instead, it’s the second home loan with a different fee. Thus, household collateral funds tend to have high rates than just earliest mortgage loans. Rocket Financial presently has the house Equity Loan, which is available for top and you can additional land.

Once the a home guarantee mortgage try a completely separate financing of your home loan, none of your financing terms for the fresh financial vary. Because home guarantee mortgage closes, you’ll get a swelling-contribution fee out of your bank, which you yourself can be likely to repay constantly at the a predetermined rate.

Lenders have a tendency to hardly will let you acquire 100% of one’s security to possess a house equity financing. The maximum amount you could potentially acquire may differ according to the bank and you will credit score, however you you’ll acquire to 90% of one’s value of the house. Just as in a profit-out refi, extent you could borrow will additionally trust facts including your credit rating, debt-to-earnings ratio (DTI) and financing-to-worthy of ratio (LTV).