Dining table From Material

When you are eyeing an excellent $350,000 family, you ought to desired getting off doing 20% or $70,000. However, there are other expenditures and you will things to dictate how much cash cash you’ll want to set out so you’re able to safer your ideal domestic.

Let us simply take a simple look at what you are in reality purchasing when you buy a property. Outside of the sticker price, you will need coverage such things as settlement costs, property taxes, and you can insurance policies.

Closing costs, with respect to the mortgage system make use of, usually generally amount to between dos-3% of your transformation rates, shares Reef Mehri, Part Movie director within Tx United Financial.

But not, what individuals may well not understand is that such expenditures will be paid back by the a 3rd party, including the merchant, the lender, or even the agent. When you are discover limits, a smart lender will help their client create a binding agreement one to enhances credits and you may expenditures on their work for.

What is an earnest Deposit?

Once you’ve receive a property you like and so are willing to build an offer, you’ll want to lay out a serious deposit showing the new provider you may be major. The degree of it put may differ but is generally to 1-2% of the residence’s cost.

The new deposit is the amount of cash you only pay initial when selecting a property. The fresh commission you’ll need to lay out can differ, but a familiar guideline is 20%.

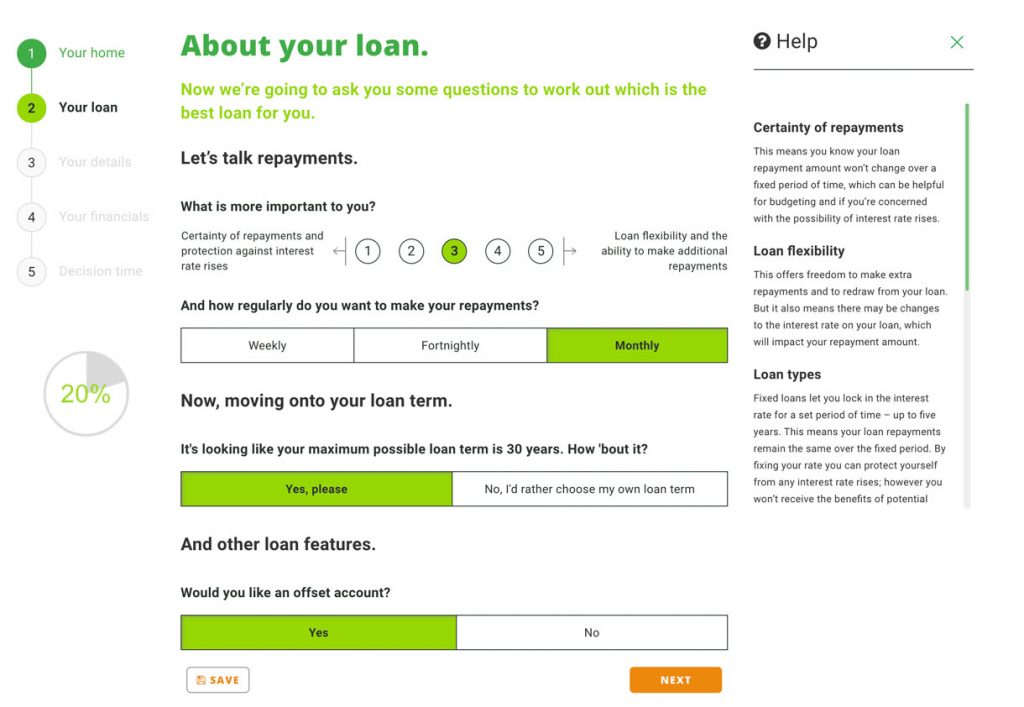

- Antique Financing: A traditional financing isnt backed by government entities and you can normally needs a deposit of at least 3-5% of residence’s purchase price. But not, for individuals who establish lower than 20%, you happen to be necessary to pay money for personal mortgage insurance policies (PMI).

- FHA Mortgage: An enthusiastic FHA financing is actually insured of the Government Homes Management and you may generally speaking need a down-payment out-of step 3.5% of your home’s cost. These types of mortgage is normally attractive to earliest-go out homebuyers just who might not have a big advance payment spared up.

- Va Mortgage: A Va financing can be obtained to active-duty provider people, experts, and you can eligible surviving partners and does not wanted an advance payment. Although not, there can be other charge for the such financing.

- USDA Loan: A good USDA financing is available for residential property during the rural areas and you will usually need no down-payment. not, you’ll find income limits or other conditions for this form of loan.

If you’re a good 20% advance payment is better, it is really not always feasible for cash loans Brush no credit check everyone. Thankfully there exists additional options available. Depending on the mortgage sort of, particular lenders give money which have reduce commission conditions, including 5% otherwise ten%. To possess qualifying consumers, FHA finance want simply step 3.5% off.

We share with people to visualize your advance payment to own a conventional loan try 5%, many commonly qualify for quicker, states Mehri. And additionally, the downpayment getting a keen FHA financing is lower in the step three.5%, while you are Va and USDA funds was 0%.

Yet not, keep in mind that a lower life expectancy down payment typically function a large monthly mortgage payment and possibly higher interest levels. And here coping with a location, knowledgeable financial becomes crucial. You need somebody who will allow you to get the best loan to suit your particular needs.

If you’d like the main benefit of settling their home loan with a deposit but need assistance in order to create the newest finance, Colorado has many higher choices. You’ll find advance payment advice applications which can be money-particular by the Texas county you are buying the house within the.

Just how Interest levels Perception Off Costs

You’ve got already been reading a lot on the rates of interest to the the news. Better, they’re able to enjoys a significant affect your own down-payment.

Designers are putting currency towards settlement costs to assist purchase down rates to help you convince consumers, shares Mehri. However, sometimes the new wiser disperse is by using men and women credits so you’re able to safety settlement costs otherwise down payments rather. It is all regarding using your currency and loans wisely to maximise their a lot of time-term masters and specifications.

Whenever rates of interest are reasonable, you happen to be able to manage a more impressive down-payment because the your monthly mortgage repayments might be straight down. Concurrently, whenever rates is actually highest like they are right now, you may need to establish a smaller percentage to store your monthly obligations sensible.

To find out what types of finance you be eligible for and you can what downpayment fund you really need to prepare, contact Tx United Mortgage today ! We are able to help produce towards a home that actually works having your budget.