When you take aside a home loan, one of the most important matters to adopt is the payment package. You’ll want to be sure that you are able to afford your own month-to-month repayments and therefore you might be more comfortable with the newest repayment plan.

One way to exercise their month-to-month payments is to utilize a mortgage EMI calculator. That it tool lets you enter in individuals facts about the loan, such as the amount borrowed, rate of interest, and repayment tenure. The calculator will then make you an offer of monthly costs.

This website article will in the IDBI financial EMI calculator. We will talk about why you ought to make use of this calculator, the way it makes it possible to pay back your home loan, and you can what other has it has got.

When taking out home financing, you need to know how much cash you will need to pay off for each and every day. That is where a mortgage calculator will come in handy. This new IDBI lender mortgage calculator is a superb tool in order to help you exercise their month-to-month money. Is why you need to use it.

- Its quick and easy to use loan places Vona.

- It’s specific.

- It is without charge.

- It will help your compare additional home loan solutions.

- It helps you plan for your house mortgage.

Just how EMI Computation Helps in Buying Household?

EMI formula is essential when selecting a house since it allows buyers to know what they may be able pay for and you can plan their budget. It is very a sensible way to evaluate some other mortgage choice.

- How much cash you can affordThis can help you know what types of mortgage you can sign up for and exactly how far their month-to-month money could be.

- Additional Mortgage AlternativesThere are various sort of home loans readily available, and opting for the one that suits your circumstances and you may budget is important. An IDBI bank financial calculator helps you compare additional loans alongside and come up with a knowledgeable decision on the and this suits you.

Exactly how Mortgage Amortisation Agenda Assists Spending EMI

Financing amortisation plan suggests the fresh occasional money on that loan as well as how those people repayments is actually put on the dominant balance together with notice due. This short article can be helpful inside cost management having upcoming costs and while making additional repayments to store to your notice and you may pay the fresh financing faster.

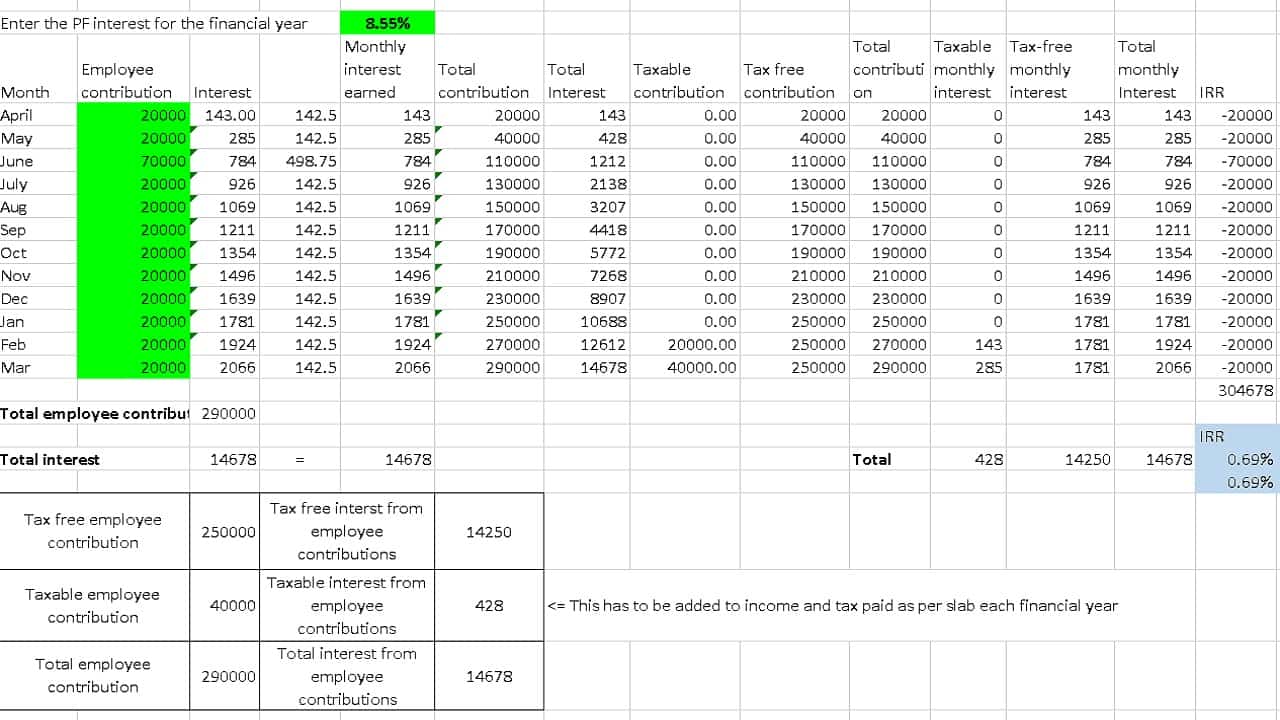

The EMI Amortisation Plan for a loan level of Rs 5,00,000 for five decades at the mortgage loan out-of seven.5% is offered below.

Comparison off Mortgage brokers with other Financial

If you are looking getting a mortgage, you need to compare IDBI lender with other leading finance companies into the India. The following is a simple testing regarding IDBI bank mortgage brokers with other popular finance companies in the India.

Clearly, IDBI financial now offers aggressive interest levels and you will control charge. For this reason, IDBI bank are the first options if you are searching to own home financing.

Situations Impacting Financial EMI

Of a home loan, IDBI Financial the most popular choices around consumers. For the reason that the bank now offers a wide range of family financing things at aggressive rates of interest. Concurrently, IDBI Financial also offers multiple worthy of-added services in order to the home loan consumers.

Yet not, it is usually advisable to examine financial facts of various other finance companies just before choosing that. This can help you obtaining an informed deal possible. Particular items that affect our home financing EMI is actually rates of interest, control charge, loan period, etcetera.

- Budget for your Monthly RepaymentsInputting your income and expenses will give you an accurate picture of how much money you have left over each month after making your repayment. This is useful information to avoid defaulting on your loan or falling behind on your repayments.

- Rates of interest IDBI Lender offers mortgage brokers ranging from 8.25% per annum.

- Running Costs The brand new running commission recharged of the IDBI Lender was 0.50% of the amount borrowed along with GST.

Advantages of choosing IDBI Loan calculator

An online home loan EMI calculator is an extremely helpful tool for everyone applying for home financing. There are numerous benefits of using an online EMI calculator, and we will talk about the all of them here.

Calculating your residence mortgage EMI yourself is a monotonous activity. At the same time, this new EMI calculator can provide a response in under a beneficial second and you may describe the whole techniques. With this specific suggestions, you could potentially simply take the best ount, period and you can interest rate. Additionally, it helps that discuss a better interest to the bank.

Rather than tips guide calculation, the result away from an internet EMI calculator was appropriate and you may fast. With this product, you can acquire outcomes for various financing quantity, tenure and interest levels.

IDBI Financial Financial EMI Calculator for various Loan Numbers

A house loan EMI calculator normally calculate the brand new estimated monthly obligations when taking aside a home loan. The newest IDBI Lender Home loan Calculator is fast and easy and you will helps you compare financing choices. It is extremely totally free. When purchasing property,

EMI calculations are essential simply because they permit people to assess their financial situation and consider the mortgage options. In addition, an enthusiastic amortisation plan for a financial loan supports believe upcoming payments and you can permits additional repayments to minimize attract and you will accelerate financing cost. NoBroker can assist you to get the very best deal on the IDBI mortgage giving you with a platform evaluate finance off more lenders with NoBroker home loan characteristics. It can also help that discuss to own a diminished appeal price.