Life in the nation was 24 hours-aspire to of a lot. But it might be possible to you personally! A USDA loan, among the many government’s minimum-understood home loan recommendations programs, gets you truth be told there!

Brand new U.S. Company from Farming is actually enabling make property possible getting low- so you can reasonable-income parents to your extra one an increase of new people can assist outlying communities restore and you can/otherwise always thrive.

Since 2017, brand new USDA loan system provides helped participants get and change their residential property by providing low interest with no down costs. Total, such loans is kepted getting homeowners looking to inhabit rural areas of the country, but in some states, suburban portion can be incorporated.

Are you currently eligible for a USDA loan?

Usually do not avoid the ability to discover more about USDA thought it is not to you. Eligibility standards for USDA-recognized mortgages depend on simply a few things. The latest USDA mortgage requirements was:

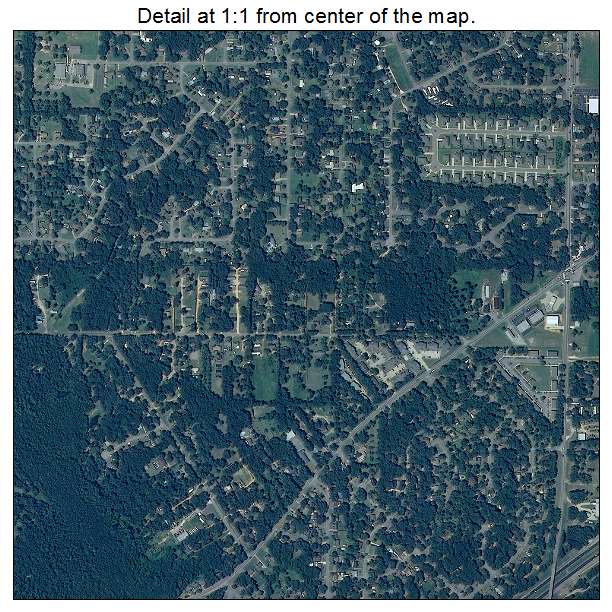

- Location: Locate a beneficial USDA mortgage, the property you get should be into the a USDA appointed rural city.