If at all possible, you should try to find a property going right on through an extensive renovation techniques rather than one that could have been leftover unaltered or in a condition of disrepair. Renovating extremely home will surely cost approximately $10-$forty for each and every square foot, with respect to the difficulty of your job. Thus, it is to your advantage to adopt to acquire things with pretty good skeleton regarding the score-go. Professional Idea: score property review and you will guess repair costs before you buy.

For almost all, to buy a classic residence is an exciting adventure. For other people, it’s an issue. However, feel you to as it may, latest investigation suggests that buyers will always be purchasing fixer-uppers. And tend to be having them for lower cost, also. However, due to the fact field actually starts to cool and you will strengthening procedure prices consistently rise, many people try providing more day to remodel. Most other pressures with the to acquire good fixer-upper have a tendency to center inside the adopting the:

- Risk

- Long-Identity Build

- Funding

- Difficulty Budgeting

- Fixes otherwise Unexpected Factors

- Restoration Will set you back

- Costly Home improvements

Today’s Financial Costs

In general, fixer-uppers try riskier financial investments as they need treatment. As a result, a lot of people assume that to acquire an older home is an awful idea. The newest care is that older property has significant difficulties with the newest foundation, roof, plumbing system, cables, decorate, etcetera., and that they will require a great amount of renovating. Biggest things also can indicate ongoing renovations, that may imply your home is for the a housing region to have days. However, to buy good fixer-top comes with some intrinsic dangers, whether it is a vintage household or an incomplete possessions. Even so, there are numerous good reasons to find a mature home. For one, they’re able to continually be less. Secondly, total, older home will need smaller restoration and you may have a tendency to cost not so much than newer homes.

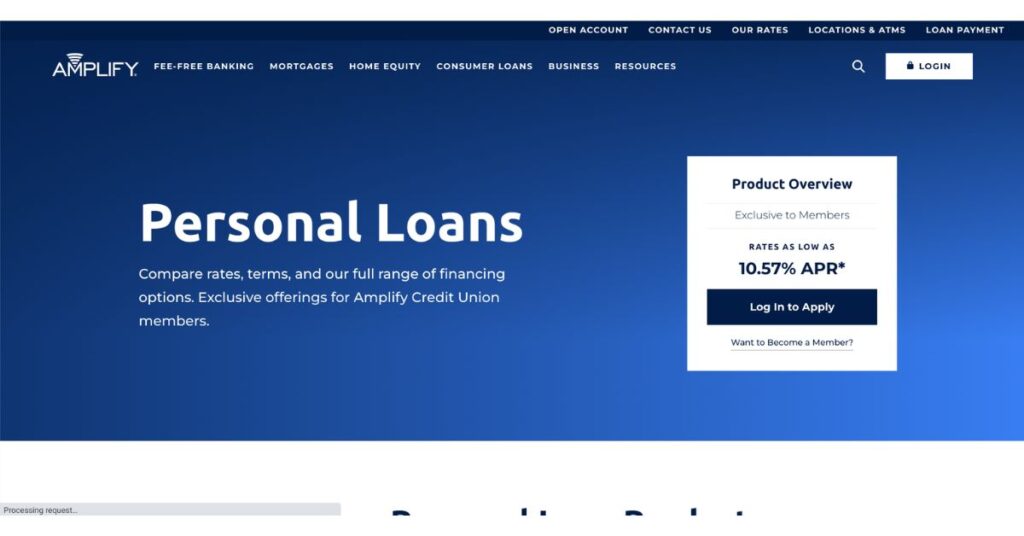

Nevertheless, wanting capital can be a primary difficulties, particularly if the household needs comprehensive upgrading. Hence, if you purchase property that needs significant solutions, you should be prepared to spend some cash. Not surprisingly, people don’t possess much more cash once deciding to make the down payment and you can paying settlement costs, very creating extra cash to fund fixes https://paydayloancolorado.net/ophir/ or building work shall be tough. As a result of this it is critical to mention fixer-higher financing alternatives including the Government Construction Government (FHA) 203 (k) rehabilitation loan or even the Fannie mae Homestyle Recovery Mortgage. You could finance the house buy which have both of them choices and have a hold during the escrow for renovations. However, for people who pick a home one to only requires cosmetic makeup products updates, up coming protecting funding would be quite simple.

Together people same lines, upgrading a vintage household and you can maintaining the home can be want permits and stay high priced. This is especially true if you buy an older fixer-top, as they often have outdated solutions, which can increase electric bills. Furthermore, to purchase a mature household generally setting to acquire an older possessions. Meaning there might be limitations on which you are able to do into the property. Such as, some earlier house might not have it allows to have home improvements. Therefore, its smart doing your pursuit right here and you may funds correctly. Thus, do oneself a favor and watch exactly what allows you may need, just what repairs have to be complete, and how much you will be charged in order to maintain the possessions before you buy.

What is the Summation?

Fixer-uppers was an affordable way to get to the a different domestic, especially in a hot housing marketplace. These financing is right for many who try at some point up to your complications. The primary should be to find the proper household that requires restricted focus on finest and has a beneficial bones.