To order a property is the biggest choice you’ll probably make. Therefore before you can orchestrate your residence financing, make sure you understand what you could might rating. Be sure to get the best financial which can complement to your purpose to become a citizen.

First-day home buyers always aren’t getting pre-recognized mortgage loans in advance of considering homes. Don’t misinterpret pre-recognized so you can mean pre-certified because most of time earliest-big date homebuyers make use of these terms and conditions interchangeably.

Brand new homebuyer have to have the applying made and borrowing taken prior to they start to look on attributes . The latest frustration and you will anger will really damage your first-date experience thus always aim for the correct something over and never guesstimate and you may have a look with certainty.

For many who ‘ lso are an initial-day homebuyer you are probably thinking of buying a property towards very first time. To accomplish this your will need to locate a home loan approved in order to facilitate the buying procedure. It is ok feeling afraid, angry and weighed down.

Fortunately, you will find handpicked the best mortgage brokers during the Ghana which you is also have confidence in getting your first fantasy home.

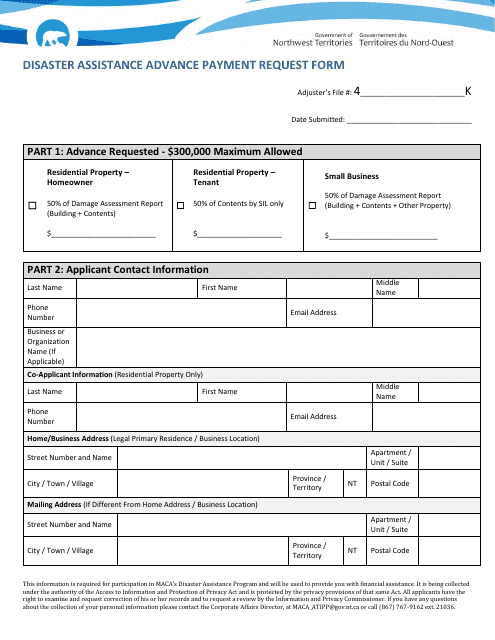

General standards getting home loan application in Ghana

To complete home financing form youre mandated to add next help judge documents to help you a particular lender:

- Evidence of income disperse and you will a career position

- Proof Label Passport, People licence, Voters Term Credit

- Evidence of Home

- Offer page throughout the creator

- Property term documents (Action regarding project)

- A good Valuation Statement out of an approved Appraiser

Breakdown of the best mortgage brokers into the Ghana

Given that the general conditions from submitting an application for an excellent home loan is identified. Why don’t we discuss the best lenders to assist you actualise your perfect out of purchasing your first household into the Ghana. Right here we browse the top home loan business within the the nation so that the visit the homeownership is done easy and challenge-totally free.

Republic Bank

We like to-name Republic Bank home to mortgage loans because they provide styles of possibilities to help you and obtain a house. They supply chances to both people and you may a property people whom need grand and you may overall financing to achieve its wants. Having Republic you really have an enthusiastic 80% Loan-To-Worthy of ratio making a down-payment out-of 20% along with an optimum 20-year installment bundle.

Republic Bank has six fundamental financial packages; they have been; Home purchase financial, Domestic collateral mortgage, Purchase, Build and you can Very own property, Family Completion Financial, Social sector household plan, and Home improvement financial.

Absa Financial Ghana

You can ‘t explore mortgages as opposed to bringing-up Absa Lender . This is because of innovative lending techniques Absa features on economic climate. Absa bank offers up in order to 90 per cent loans having house pick or over to 70 percent to have security launch and you will home improvement.

Consequently you may have simply 10 % down-payment so you’re able to get home loan approved. Having Absa you can buy a maximum loans-service-proportion from 50 % according to your earnings plus the worthy of of the house you should get.

Absa has the benefit of a fees title of five-20years combined with assets insurance coverage and borrowing insurance level dying, permanent disability and retrenchment.

Very first National Financial

Whether you’re a first-date buyer, to acquire so that or and make a completely get, Earliest Federal Lender can help you get the very best financial in order personal loan for wedding cost to very own your house. With the earliest-day mortgage, the box is perfect for the individuals looking to purchase their basic house and want the fresh much-requisite property purchase homework.

More glamorous part of FNB mortgages is they is accessible to residents and non-owners and you will buy financing in GHS, USD or GBP and up so you can two decades so you can solution this new financial.

To view which mortgage all you need is to identify a house you wish to and acquire, discuss this new terms of purchase towards the merchant to get an enthusiastic give letter to the assets to help you be eligible for your first-Date Consumer Financing.

Because the a first-time homebuyer, you can aquire your dream domestic even although you are unable to improve the mandatory lowest down payment. Basic National Bank also provides a 100 % house get financing having a supplementary insurance coverage all the way to 30 % of your own cost of the house.

Stanbic Bank

This really is other low-be concerned destination for first-go out homeowners to get a rate into a home loan. Stanbic Financial offers different financing choices to pick from 6 other mortgage factors. It’s not necessary to love the maximum loan amount you will get since it is totally dependent on your credit history.

You can also want to pay-off the loan during the rate you will be at ease with. This new six other lenders Stanbic Bank offers through the following the: House Get, Refinancing, Collateral Discharge, Do it yourself, Boss Class Mortgage Plan, and you can Designer Design.

Cal Bank

The intention of the Cal Financial Mortgage is always to convenience individuals within visit and obtain dream house. Possible people are able to access the brand new fund to track down their well-known house. Before you apply to possess Cal Lender financial you truly must be an income earner and old between 21 and you may 55 age to help you be eligible for the borrowed funds.

That it mortgage was designed to getting a retail device designed so you can meet up with the mortgage need of every buyer. Should it be Home End, Do-it-yourself and you can Guarantee Release, you have a chance for possessing your residence.

Having House Completion, the property will likely be in the lintel top so you’re able to meet the requirements and must be supported by an area Term Certificate. The home financing possess a tenure of 5 in order to 15 years.