Direct USDA Financing

USDA Lead finance are given to own qualifying reasonable-earnings individuals with interest charges as low as step one%. Head USDA financing is the place USDA funds mortgage brokers directly to the newest borrowers. Head finance was given by USDA. USDA lead financing is mortgages getting lowest- and really lower-income home loan people. Earnings thresholds vary from the part. Which have subsidies, focus pricing can be only 1%.

The fresh USDA essentially things lead finance to have house out-of 2,000 sq ft or a lot less, with an industry worth in put mortgage limitation.

Once more, that’s a shifting objective counting on where you remain. Lenders is just like the too-much while the $five-hundred,000 or even more in the very-valued real estate markets for example Ca and you will Hawaii so that as absolutely nothing because the merely over $100,000 when you look at the elements of rural The united states.

USDA Guidance toward USDA Do-it-yourself Loans

USDA Home innovation fund try to have home owners and work out servicing or enhancements on their properties. This type of money help low-earnings Americans fix otherwise improve their land. Domestic innovation finance and features: These types of fund or downright economic awards enable it to be homeowners to restore otherwise enhance their houses. Bundles also can mix a mortgage and you may an offer, providing as much as $twenty seven,500 inside the help.

Going one step further in aiding prospective homeowners, for each USDA guidelines, the latest USDA makes sure mortgage loans so you can people considered to get the top you would like. This means a man or relatives that: Was versus very good, safe and you will sanitary property. Cannot secure a mortgage out of conventional provide. Possess an adjusted earnings at otherwise within the reduced-money maximum on place where it stay

Qualifying Getting an effective USDA-Sponsored Mortgage Verify

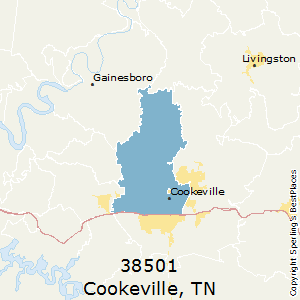

Qualifying for an effective USDA-backed mortgage be sure. Monetary constraints in order to be eligible for a mortgage to ensure are very different from the town and you may trust family relations dimensions. To get the mortgage to ensure money maximum on county in which you stand, check with which USDA map have a glimpse at this link and you may table. USDA mortgage brokers try for owner-occupied first residences.

USDA Guidance to your Personal debt-To-Earnings Ratio

A payment per month – and additionally principal, desire, insurance, and taxation – which is 30% or less of their monthly earnings. Other month-to-month financial obligation debts you will be making can not surpass 41% of the earnings. not, the latest USDA commonly envision upper loans percentages when you have good credit history a lot more than 680. Reliable winnings, always for around 2 years.

USDA Financing Credit Guidelines

An appropriate credit history background instead of a merchant account transformed so you’re able to selections within the last one year, certainly one of different criteria. If you you can expect to show that your credit rating is actually influenced by factors that have been short term or outside their manage, along with a clinical crisis, you might nonetheless be considered.

How come The latest USDA Home loan Process Performs?

Suppliants which have a credit score out-of 640 or finest found streamlined processing. Less than one to, you really need to fulfill much more strict underwriting standards. You can be eligible having a non-conventional credit score background.

People which have a credit rating off 640 otherwise most readily useful receive sleek control. People with analysis under which will satisfy more stringent underwriting requirements. And the ones instead a credit rating, or a restricted credit rating record, can be be considered that have nontraditional credit history recommendations, particularly leasing and you will electric speed records.

USDA Advice on Qualified Belongings

Not all house is be eligible for a good USDA Loan. USDA advice merely allow it to be proprietor-tenant number 1 house for the an excellent USDA-appointed county qualified to receive USDA loans. That four-unit belongings normally be eligible for an excellent USDA loan. You can not explore good USDA financing to shop for the second home or investment property. Urban places are usually excluded out of USDA programs. not, purse away from opportunity normally occur regarding suburbs. Outlying places are continually qualified.