Perfectly inside our early in the day blog post , this short article will break apart the key benefits of the fresh new Virtual assistant loan than the traditional money. Simultaneously, we shall speak about certain key facts worth deciding on whenever discussing an excellent financing. In the event the at any point you’re unsure from what you are entering, ask your realtor otherwise mortgage officer. They must be able to make it easier to from the process.

If you have ever purchased an auto just before, you’ll be able to klnow in the down costs. For having some form of purchasing need for a assets, really finance companies require you to legs some of the expenses right up front side. Traditional home loans want a down payment around 20% or might ask you for an extra payment entitled PMI. The Virtual assistant financing does not require any cash down and you may really does maybe not charges PMI.

Precisely what does which manage for your requirements? State youre trying money a $100,000 house. Having a traditional financing, you’ll be needed to pay $20,000 in advance otherwise spend a supplementary commission towards the financial should you standard. Brand new Virtual assistant mortgage waives the newest $20,000 needs and does not require that you shell out it commission. This permits one very own a property and no currency down, which is a chance we do not get.

Glamorous Prices and you may Solutions

The main Va financing was protected by authorities and you’re allowed to comparison shop having investment instead of needing to use a singular source for the loan. Precisely what does this suggest? This means loan agents is actually fighting for your business. When people try competing for your business, you get down pricing. Straight down pricing indicate you only pay less for the focus throughout the years and you can create collateral of your house faster. We are going to discuss what it means later.

In terms of solutions, brand new Virtual assistant loan has actually a number of that will help you the bag in the future. Very first, you have the option to pre-spend at any time. Some financing has pre-commission punishment. This means that you are penalized to have paying off the loan very early. Virtual assistant funds commonly allowed to ask you for getting spending very early so you’re able to pay off your property as quickly as you’d such as for instance. Next, you can use your loan having property, condo, duplex, otherwise newly depending domestic. Such solutions allows you to possess alternatives within the your geographical area. 3rd, brand new Va loan was assumable. This implies you to definitely oftentimes you could transfer the loan to some other Va-qualified personal. Whenever you are having problems Utah title loan selling your home, including, you can import the loan to another Va-eligible private. If the rates is ascending, this might help you significantly.

The latest Financial support Percentage

This new Virtual assistant mortgage does wanted a funding commission that helps with resource upcoming finance. In many cases, wounded experts while some have this payment waived. Consult your lender for qualification. This new graph more than suggests this new capital payment called for while the a percentage of your home rate. It is a single date fee to pay up front side or financing as well. Returning to our earlier in the day example, if you buy a beneficial $100,000 home with no cash down, your investment fee was $dos,150 if this sounds like the initial home you have purchased with your Va financing.

Strengthening Collateral and you may loan solutions

Sorry for everybody of your humdrum tables! But not, what is actually present in such tables deserves the looks. The brand new dining table above will allow you to choose whether or not to fool around with a 15 otherwise 31 12 months mortgage based on how you happen to be strengthening collateral.

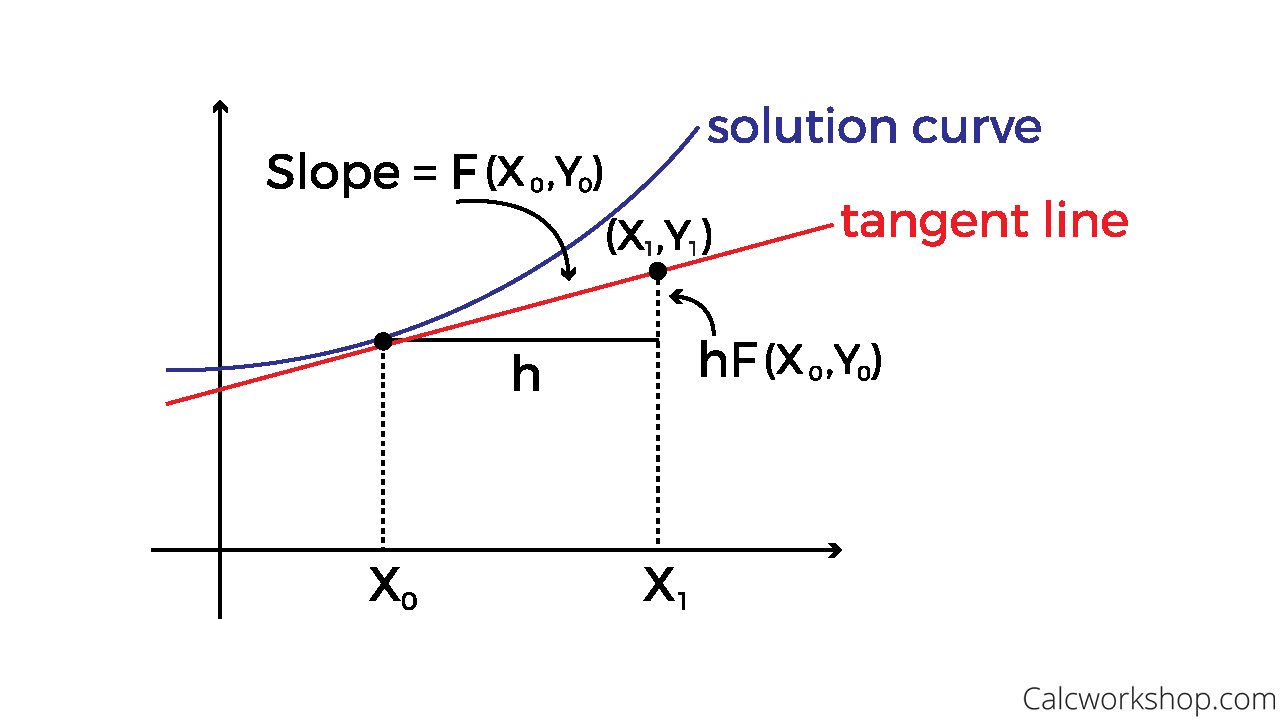

Your own month-to-month loan percentage is made up of two parts, dominant and desire. Dominating is actually currency going really to your possession of the house. Desire is currency reduced into the lender for money the mortgage.

Your aim will be to generate enough dominating so that you in the course of time very own your house outright. The tables significantly more than tell you good $100,000 mortgage within cuatro.5% interest. The top section suggests a thirty seasons mortgage, the bottom part reveals an excellent 15 12 months financial. Notice the fee was higher on the 15 year home loan. The reason being the loan was spread out more 15 years unlike 30. Yet not, more than good fifteen year financial you only pay faster attention therefore build principal reduced. Notice the balance on far right column decreases a lot faster to your 15 12 months mortgage.

BLUF: If you possibly could afford a beneficial 15 season mortgage, you pay out-of your house smaller while spend quicker focus.

When you’re wanting powering the new data yourself, click here. One area i did not discuss today try variable speed mortgage loans. I highly advise you remain apprehensive about Arms. People interest in discovering a little more about Possession, feel free to post myself an email. $